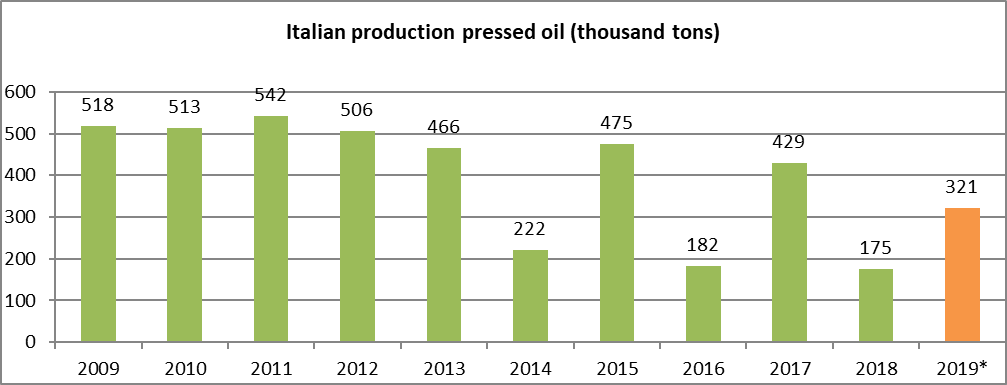

On the basis of the recommendations received from the production areas, ISMEA – Institute of Services for the Agricultural Food Market – estimates for Italy a production of 321,000 tons of olive oil (an increase of 83% compared to the previous olive oil campaign).

Sorce: ISMEA Trends

National growth returns after the terrible campaign of 2018, although this year’s production appears far from being considered a “full load”. The estimated value is in fact slightly higher than the average of the last four years; however this average considers two very poor results (the of 2016 and 2018).

The production increase was smaller than expected due to a persistent cold during flowering followed by a sudden arrival of heat in the setting phase, the initial part of fruit development. Furthermore, the dry summer caused some water stress, while an autumn characterized by strong winds and thunderstorms triggered some fruit falling.

The recovery in production, although reduced, starts with southern Italy, in particular Puglia, which in the past campaign had been the most damaged region due to frosts. Unfortunately, a particularly windy autumn with strong rains has diminished the productive potential.

In Calabria an abundant production is expected although it is estimated that the losses of last year will not be fully compensated.

In Sicily an excellent flowering promised a favourable campaign, but the harvest was reduced due to adverse weather conditions during the fruit setting phase and a long summer drought.

An opposite situation occurred in the North and Central regions, heavily penalized due to the physiological “Alternate Bearing” and the unfavourable climatic conditions that accompanied almost all phases of olive tree development.

Although Tuscany and Umbria show a 30% drop in production, the situation is decidedly more critical up North: -60% in Liguria and -80% in Veneto and in the whole of the Garda area.

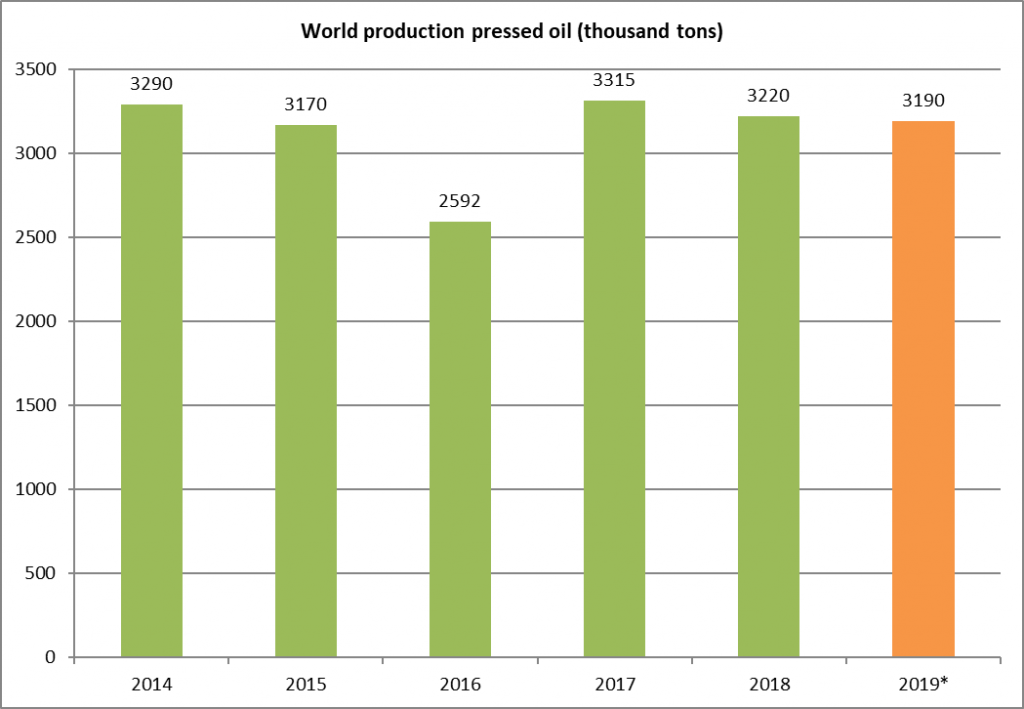

The total global olive oil yield for the 2019/2020 season should essentially confirm the same value as the previous year with a different breakdown at national level:

the production performance is estimated at around -30% for Spain and could be largely offset by the growth shown by Greece (+62%) and Tunisia, more than doubled compared to last year, as well as Portugal (+25%) and clearly Italy (+84%).

According to data released by the EU Commission the new campaign opened with 859 thousand tons of product still in stock (of these over 750 thousand are in Spain). The estimates from this year’s production, as well as the carry-over from the more than abundant 2018/2019 campaign are at the basis of a strong price reduction recorded for every commodity exchange.