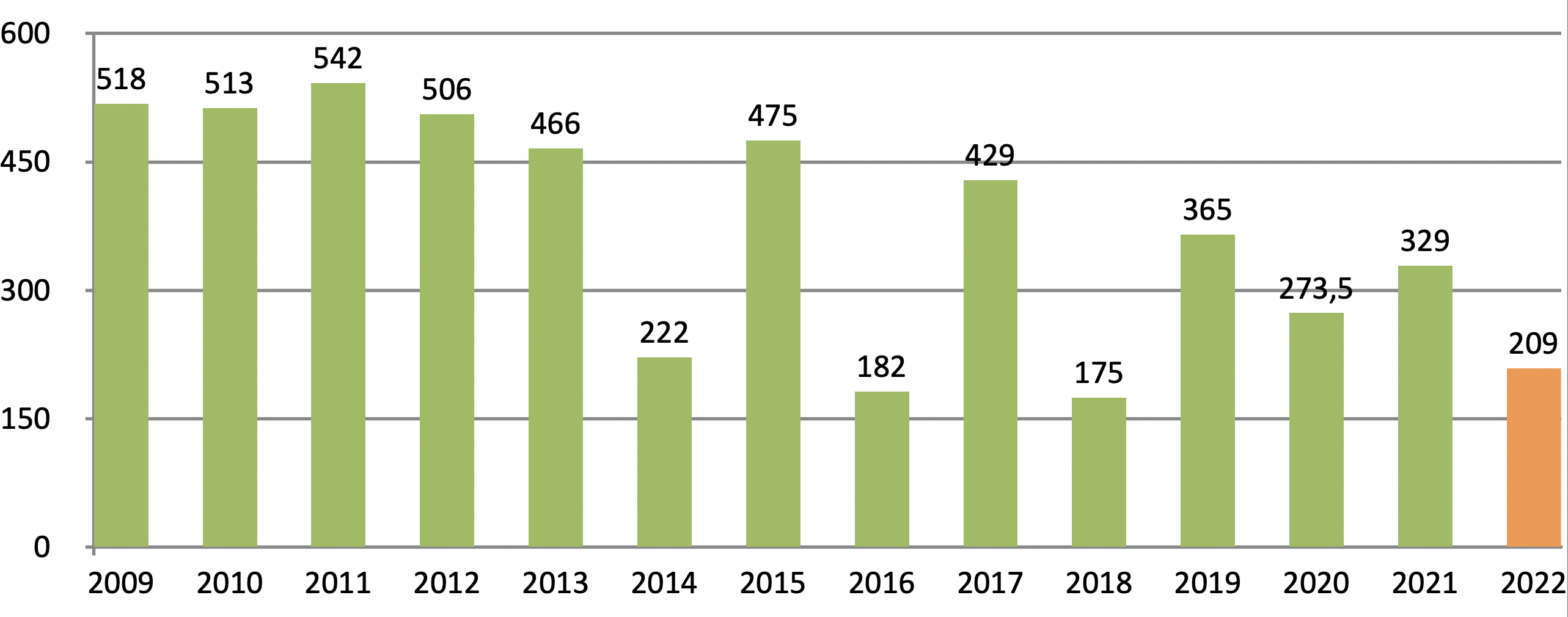

Production estimates prepared by ISMEA in collaboration with Italia Olivicola and Unaprol, and based on the latest survey at the beginning of November, indicate that production of olive oil in Italy in 2022-2023 should amount to 208,000 tonnes, a decrease of 37% on the previous season.

Italian olive oil production (thousands of tonnes)

Climate problems have affected Italian production, especially the long drought and high summer temperatures, which made it hard for the olive trees to put on growth. However, there is also the fact that in many areas with greater olive cultivation the harvest that has just started is already expected to produce a low-yield crop in terms of alternate bearing.

Nevertheless, the long drought had the general effect of preventing the spread of pests and diseases, and this has allowed many areas of the country to achieve higher than normal levels of quality.

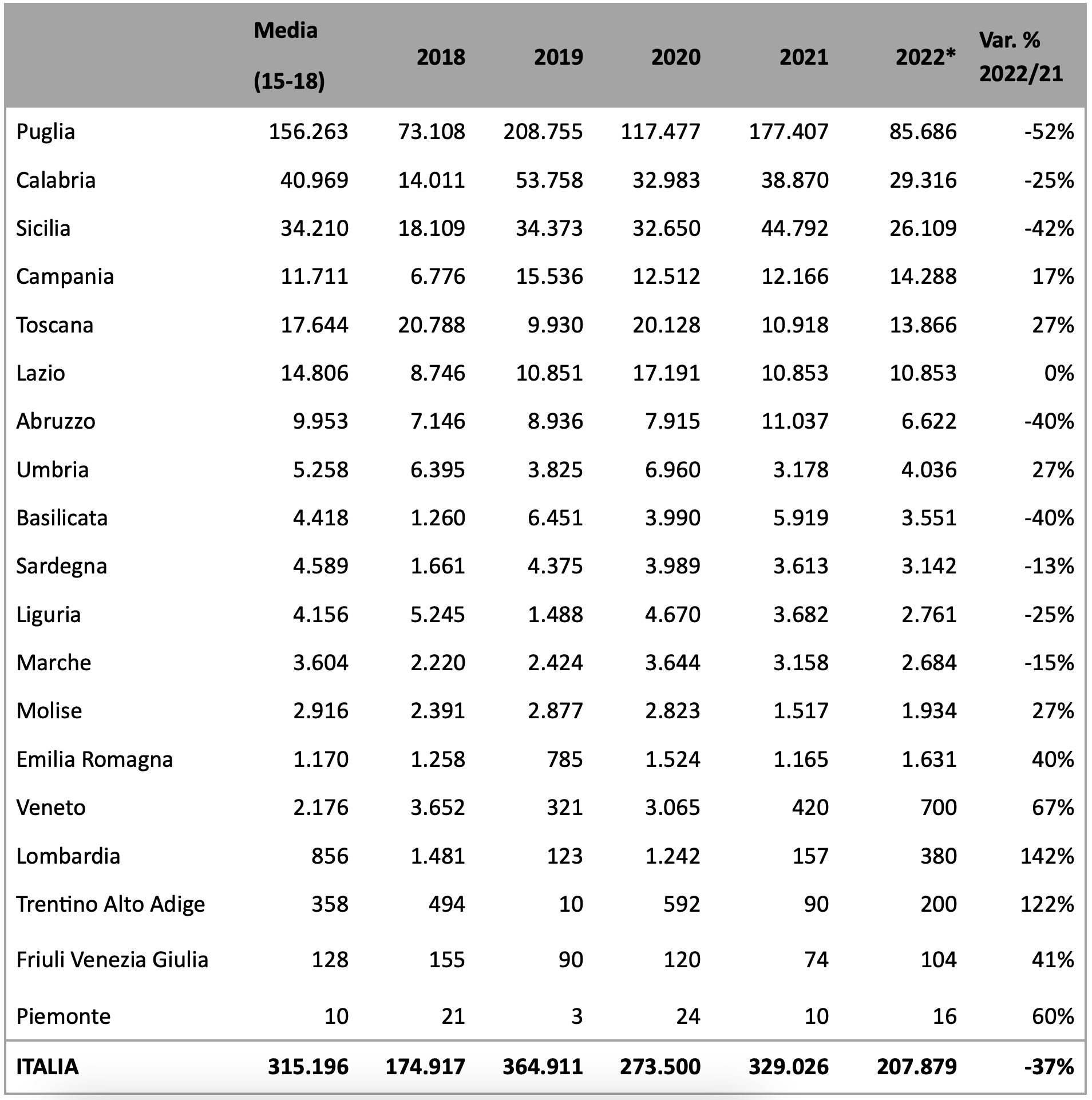

Puglia alone accounts for 50% of Italy’s oil, and ISMEA estimates that production here more than halved (-52%). There is a similarly negative picture for Sicily (-25%), Calabria (-42%) and, more generally, for the entire south. On the other hand, the season looks generally positive for Central Italy: production is expected to increase for Lazio (+17%), Tuscany (+27%) and Umbria (+27%), compared to a decrease in the Marche region (-25%). After the dramatic reduction of last year, the harvest in the northern regions is currently expected to be good, although not at the levels anticipated before the great summer drought.

Italian production of pressed olive oil (tonnes) - divided by region

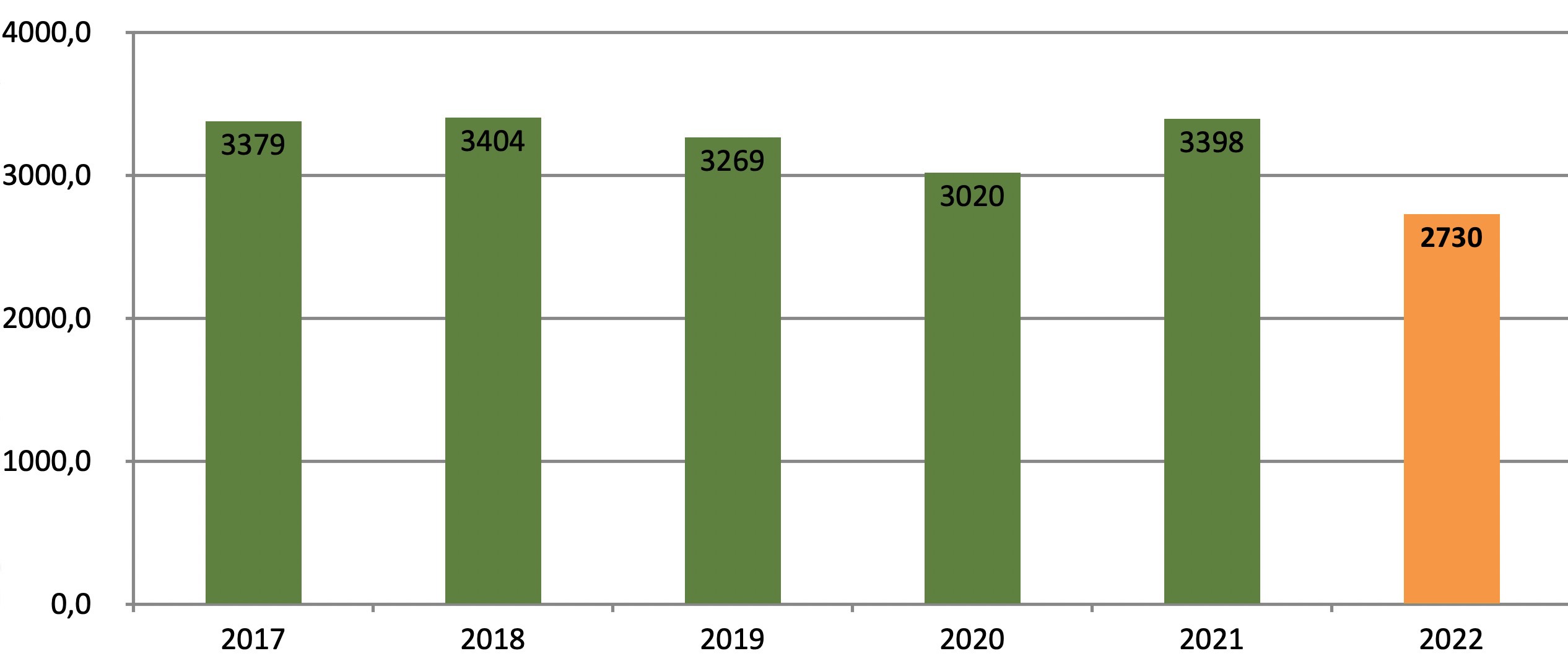

Forecasts for global availability are also pessimistic.

The International Olive Council (IOC) estimates that global production will be at its lowest level for the last six olive oil seasons, with predictions it will only reach 2.73 million tonnes.

Worldwide production of pressed olive oil (thousands of tonnes)

The situation is particularly critical in Spain, where production is expected to fall by between -30 % and -50%. Among the top olive oil-producing countries, it is estimated that only Greece will top last year’s levels, with production above 300,000 tonnes. Outside the EU, Tunisia is also expecting a low-yield crop in terms of alternate bearing, with production down by about 25%.

Because of the factors outlined above, and a significant increase in costs (energy, consumables, etc.), prices have risen significantly throughout the olive oil supply chain.

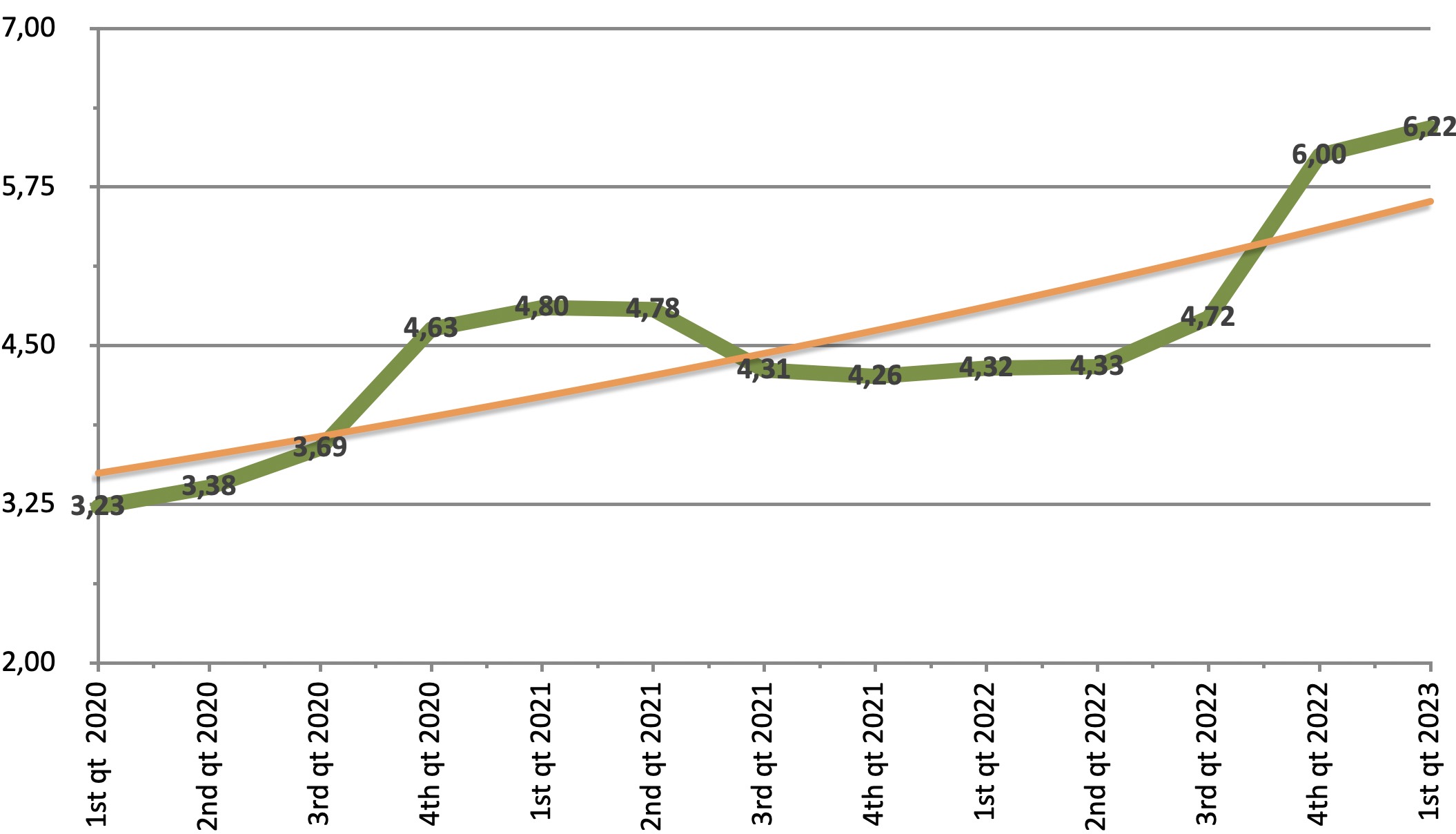

Movements in the price of extra virgin olive oil with acidity below 0.4 degrees